The Business Collection Forms are free to download for your small business.

The collection forms for your business are important tools that will further assist you in extending credit and securing payments.

For example, the Installment Promissory Note is used to guarantee loans or other debts. The Wikipedia definition is a form of promissory note calling for payment of both principal and interest in specified amounts, or specified minimum amounts, at specific time intervals. This periodic reduction of principal amortizes the loan.

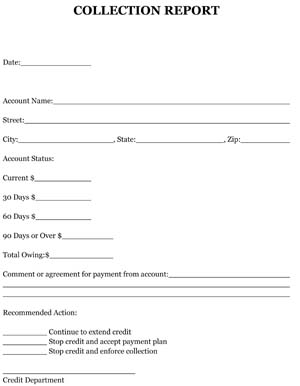

The Collection Report is a report on individual collections with a Recommended Action to continue to extend credit, etc.

The Agreement of Compromised Debt form is a short agreement between Creditor and Customer whereby the Creditor agrees to forgo part of the outstanding debt while the customer acknowledges its’ indebtedness (full sum) to the Creditor. This agreement contains the following clauses:

- Agreed compromised sum and repayment schedule thereto

- Right of Creditor to claim the full sum (rather than the compromised sum) in the event of default

- Right of Creditor to claim legal expenses in the event of default

- Nature of the agreement

- Jurisdiction

FYI: Always remember that no matter where you find business forms (paying for them or free of charge) they should never replace the advice of a lawyer. We advise you to have your lawyer review the forms for state specific laws and any other questions you might have regarding the forms.

Click on the link(s) to download the business collection forms below:

Debt Collection Worksheet

Agreement of Extend Debt Payment

Agreement of Extend Debt Payment

Notice of Auction of Collateral

Notice of Auction of Collateral

Request to Solicitor or Collection Agency

Request to Solicitor or Collection Agency

Final Notice Before Legal Action

Final Notice Before Legal Action

Settlement Offer on Disputed Amount

Settlement Offer on Disputed Amount

Cancellation of Stop Payment Order

Cancellation of Stop Payment Order

60-Day Past Due Letter

90-Day Past Due Letter

60-Day Past Due Letter

90-Day Past Due Letter